It’s been another roller coast ride in the markets for investors this week. The Loonie and TSX finished the week up as a result of rebounding oil prices, after taking a nosedive earlier in the week. If you’re using the classic “buy and hold” strategy with your portfolio and you’re keeping an eye on markets, you’re probably a nervous wreck.

Last week we wrote about another investment strategy besides the classic buy and hold – Tactical Asset Allocation (or TAA for short). We’d like to expand further on this concept with this week’s article, “How Market Downturns Affect Your Portfolio”, which further bolsters the need for the TAA strategy.

Markets are Becoming More Volatile

The facts speak for themselves: markets have become a lot more volatile in the last 16 years or so. Since 2000, we have seen much deeper losses and more frequent losses than in previous decades. Although markets always move in cycles, the degrees in the swings are much more pronounced making investors bite their fingernails. In the 2000s we had two major market meltdowns: “the dot com bubble” and the “subprime mortgage market fiasco”. To put this into context, this is coming off the heels of the longest running bull market in North American history, going from 1982 to 2000. Take a look at the chart below – as you can see, the volatility has increased drastically since 2000 and has not abated:

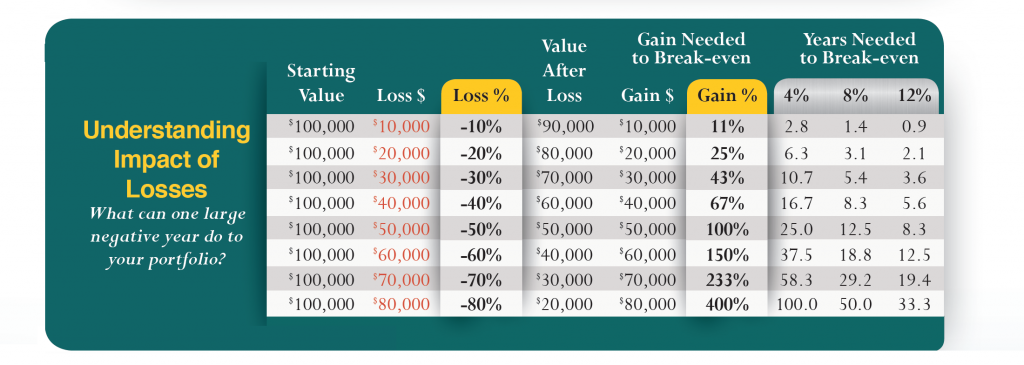

When you use the buy and hold strategy, it means holding on to those assets for an extended period of time regardless of market conditions. While this may work out for you in some situations, it can also leave you open to steep losses. For instance, how could one year of steep losses affect your portfolio? Let’s see:

As you can see in the chart above, a 30%+ loss could take years to recover from. For instance in late 2008 – early 2009 the S&P TSX lost close to 50%, it was not until mid 2014 that it got back to its previous highs. That’s 6 years just to get back to positive! What this presents is lost opportunity to actually grow your portfolio rather than just playing catch up.

When you use the TAA strategy, you just don’t sit there and hope for the best. The TAA Strategy uses an active role in managing your portfolio, which involves rebalancing the assets inorder to take advantage of market pricing anomalies and booming market sectors. In plain English, this means that the TAA Strategy will be able to get your investments in and out of markets as needed, thereby reducing overall risk and increasing overall return. Although no one has a crystal ball to predict the future, it appears the current volatility is the new norm – at least that’s what the last 15 years or so tells us. A TAA strategy doesn’t mean there won’t be losses, rather, the point is to reduce the frequency and degree of those losses. Although the markets always bounce back, you aren’t starting from as far behind as someone using the buy and hold strategy.

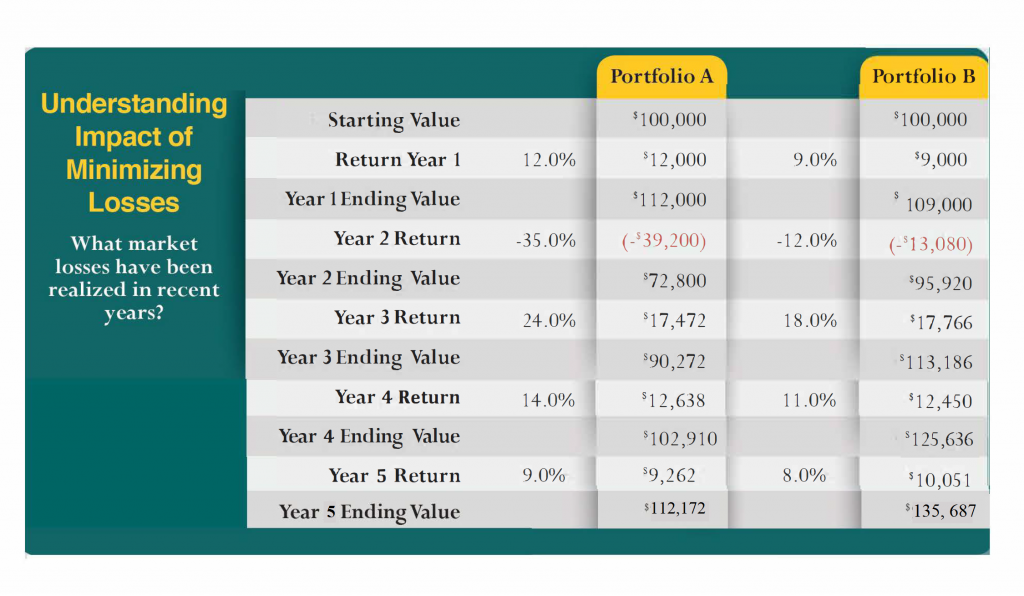

If we look at the example of a fictional couple who are planning to retire and take a vacation, they would have less because of the huge losses incurred.

With a bigger portfolio, these losses would be magnified. This could be one less year of retirement income, lower overall income in retirement, or even the need to work an extra year or two to make up for the losses in the portfolio. Over a longer period of time, the gap between both portfolios could begin to widen as volatility increases. As mentioned, a TAA strategy does not guarantee that there won’t be any losses, the goal is to minimize those losses in bear markets, thus minimizing the impact on the overall portfolio. Conversely, in bull markets a TAA strategy may not necessarily knock out the lights and give you the highest return either but it would position you to take advantage of the market gains due to it’s active nature. Looking at the table above, it is obvious which portfolio most investors would rather have. Generally, a TAA Strategy would provide you with a more stable growth with a minimized risk factor, which not only provides you with a generally higher return, but an overall peace of mind.

If you’re tired of the same old, same old with buy and hold and you’re looking to try out a new investment strategy, feel free to contact our office. We’ll walk you through the TAA Strategy to make sure you’re better protected the next time the markets decide to take a nosedive, so you can sleep better at night – and be sure, there WILL be a ‘next time’.